Corporate /debtor receipting (for amex & diners merchant fees)

Corporate /debtor receipting (for amex & diners merchant fees)

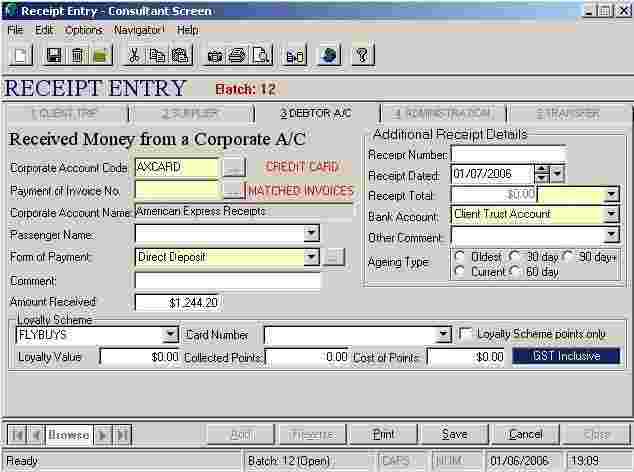

This area is also used once funds due from Amex and Diners have hit your bank account and have appeared on bank statements. The amount on your statement will be the actual amount receipted via your EFTPOS Terminal LESS the credit card ‘Merchant’ Fees. By completing this debtor receipt, it will account for those Merchant Fees & relevant GST. NB* Default Fee amounts (%) are set within the ‘Codes Maintenance’ area.

Note: The SPACE BAR will allow you to UNMATCH incorrect items prior to saving the receipt.

- Go into the Debtor Account / Corporate Receipt type and click on ADD.

- Enter the Debtor Code for the Amex (or Diners) Account.

- Click on the Browse Payment of Invoice No. Box.

- This will bring up a list of RECEIPTS that have been entered with the payment types of Amex / Diners previously.

- Type ‘P’ in the ‘Matched’ column to partially match the receipt. The amount less the fees will default. If the amount is slightly different eg; amount out by .01c you can simply overtype the amount so it matches to your bank statement amount exactly.

- Click on OK.

- NB: The Payment method is Direct Credit and NOT Amex or Diners.

- Make sure the receipt dated and the Bank Account are correct.

- Remember for this receipt to appear on the bank reconciliation you need to List/Update.

Copyright © 2017 - Travelog Pty. Ltd. ABN: 67 099 078 985